Rise and shine everyone.

We have 6 Fed Speakers today… including the Fed Chair, Powell, who speaks at the Economic Club of New York at 12pm ET. All eyes will be on Chair Powell’s speech to see if he toes the line with other Fed speakers about the surge in treasury yields doing their job of tightening for them. This could bring some relief in longer end rates that have been surging yet again since yesterday. Rates continue to trend higher this morning, with the 30Y at 5.065% and the 10Y closing in on that level at 4.979%.

US Equity Futures remain muted, after yesterday’s sell off. Tech stocks are mildly higher after Netflix earnings yesterday, causing the stock to soar. It’s up +13.5% in pre-market trading. Tesla however, missed on every metric and after Elon Musk’s softer tone on the earnings call, the stock sold off and it’s down -7% in pre-market trading.

Crude Oil has pulled back from yesterday’s high’s. Yesterday, US crude stocks saw a much larger than expected weekly draw. But the big news overnight was the official announcement of sanctions relief on Venezuela, which will enable the country to export without restriction for the next six months provided it lives up to commitments to liberalize its political system.

Gold remains elevated at $1951/oz. Base metals are also trending higher while the US Dollar is largely flat. Bitcoin continues to rise now at 28,452.

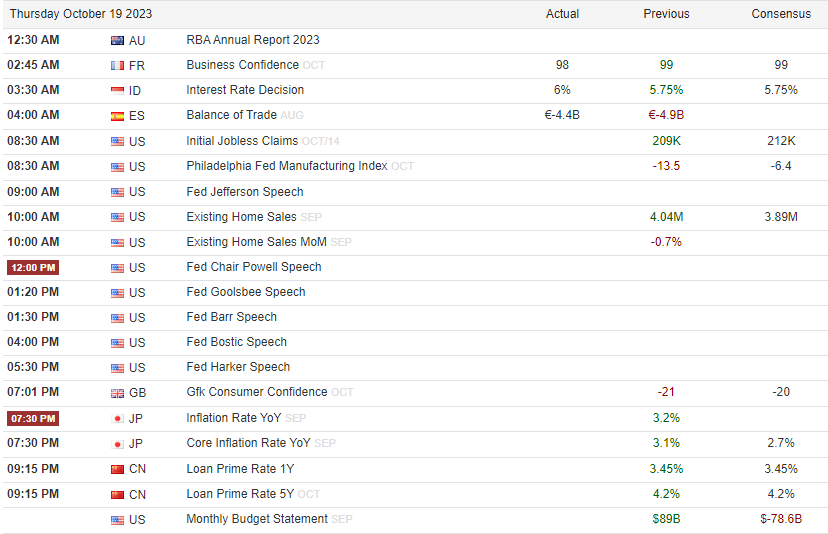

Initial claims, existing home sales, Conference Board's leading index on the US economic calendar this morning.

Asia and Australia

Asia equities ended sharply lower Thursday. Almost all benchmarks finished lower with MSCI Asia ex-Japan index down 1.5%. Hang Seng among the steepest fallers as its high-growth and energy sectors fell sharply; mainland benchmarks also lower across the board. South Korea notably underperformed amid a hawkish central bank statement, Taiwan a few points higher as TSMC beat on Q3s.

Bank of Korea held benchmark 7D repo rate unchanged at 3.5% Thursday, as widely expected. Bank said it will maintain restrictive policy stance for considerable time, will monitor inflation slowdown, economic downside risks, household debt, monetary policy changes in major countries.

Indonesia's central bank (BI) surprised late Thursday by hiking its 7D reverse repo rate 25 bps to 6.0% as it moved to stabilize sinking rupiah currency. Unexpected move comes despite inflation hitting 19-month low in September of 2.3%, core at 2.0%, both well within BI's target range.

China's new house prices fell 0.2% m/m in September, extending declines for third straight month and came after 0.3% drop in August.

Australia job growth slows, but unemployment rate unexpectedly dips. Headline employment rose 6.7K m/m in September, below consensus 20K and follows revised 63.3K in the previous month. Sharp gains in part-time largely offset by weaker full-time jobs.

Japan trade data mixed, export volumes turn positive - Customs exports rose 4.3% y/y in September, above consensus 3.1%. Follows 0.8% decline in the previous month and marks the first increase in three months. Main drivers were autos and drugs, though semiconductor equipment and parts were among the biggest drags.

Europe, Middle East, Africa

European equity markets lower. Healthcare, auto stocks, real estate and energy lead the move lower, while technology, utilities and personal/household goods outperform.

French business confidence weakened in October to 98 versus consensus 99 and prior 99, leaving it two points below its long-term average of 100. Sentiment in retail trade weakened sharply from prior month with fall to 98 versus 103 in September amid general retreat in business outlook and fall in ordering intentions.

The Americas

Tesla Q3 revenue missed the Street by 3% while EPS also below the Street. Key automotive GM metric was 16.3%, down from 18.1% in the prior Q, worse than the 17.6% consensus and lowest since 1Q19. In terms of guidance, company reiterated goal to deliver ~1.8M units this year and said Cybertruck remains on track for initial deliveries later this year. Takeaways focused on the meaningful margin drag from the company's price-cutting strategy, though also stressed that this was widely anticipated. Margins also adversely impacted by plant idling, Cybertruck expenses, AI and R&D investments and FX.

Netflix Q3 revenue largely in line while EPS beat by ~5.5%. In addition, net adds came in at 8.8M, well above the 5.5M consensus. Company guided for Q4 net adds similar to Q3, which would put them above the 7.7M consensus. Takeaways flagged the results/guidance as better than feared amid the negative sentiment into the print amid concerns about pricing and margins.

Chart of the Day

Yesterday’s housing report shows building permits down -4.4% MoM vs. +6.8% in August. Housing starts however, flipped positive to +7% MoM vs. -12.5% in August. The weakness was concentrated in permits for multi-unit dwellings. Single-unit starts were up 3.2% and single-unit permits rose 1.8%, which is welcome for a supply-challenged housing market.

As the chart shows however, homebuilders have started to lose their strength and could see another leg down based on the data from building permits and housing starts.

Calendars

(news taken from Reuters, FT, Bloomberg; Calendar from Newsquak and Trading Economics)