Rise and shine everyone and Happy March!

Even though today’s the first Friday of March, we don’t have the US employment report coming out. I suppose it’s too early so the release will be next Friday, March 08. But, we have a few other pieces of important macro data… and five Fed Speakers to keep us entertained!

We closed out February on a positive note across US Equity Indices, on an inline PCE Inflation report and higher continuing jobless claims. Given the reaction to the hotter CPI number, the market likely feared a more adverse reading.

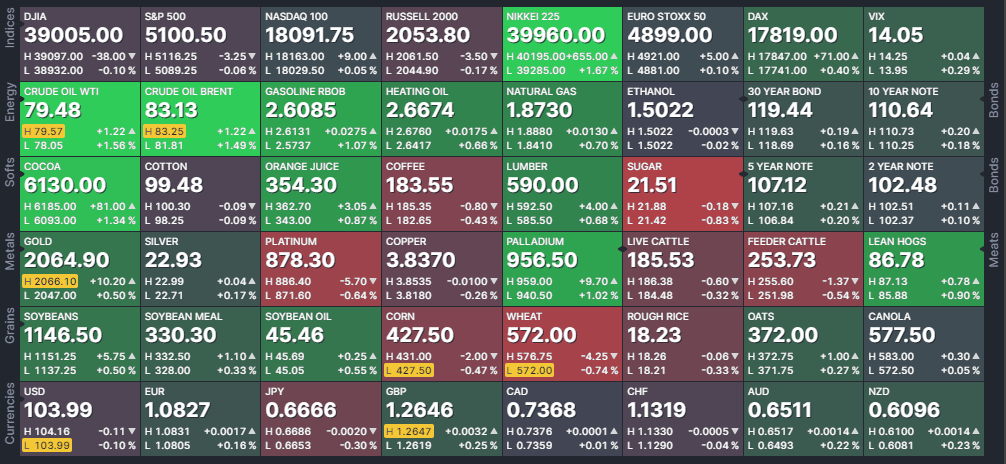

Equity markets in Japan and Australia hit another record high, continuing the run seen in the US yesterday.

US Equity futures, however, are lower in the pre-market now after hotter European Inflation numbers (more below) and NYCB’s little stunt of removing their CEO and copping to material weaknesses.

Yields have softened somewhat, as has the US Dollar but continue to remain elevated. Oil is rising today, alongside Gold and Bitcoin.