Welcome to another issue of the Weekend Edition!

Thank you for reading and subscribing to our newsletter.

Here's what we cover

Market Recap - Yields put pressure on stocks

06 Jan - 10 Jan 2025

Source: Koyfin

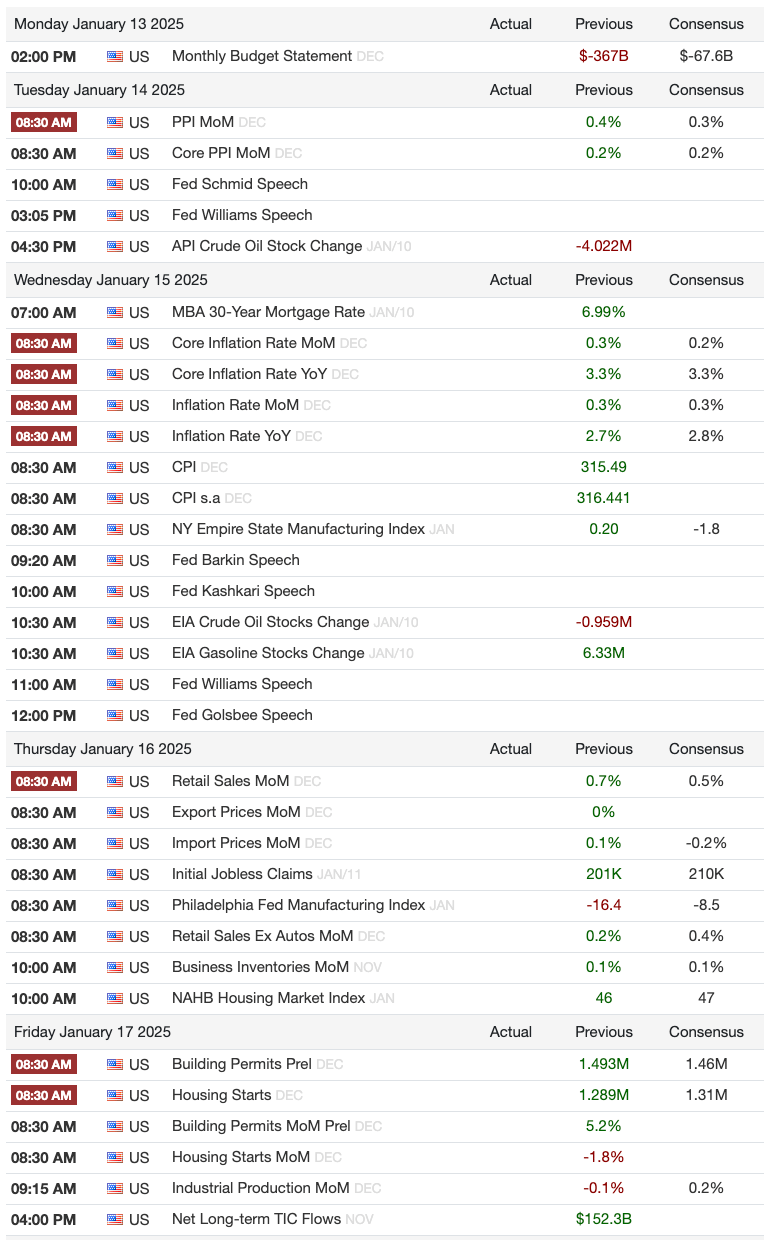

It’s been an extremely choppy week, with all the broad market indices ending lower. Much of it was attributed to yields moving sharply higher, particularly at the long end. The S&P500 closed the week out at 5828, and we’re getting closer to the 5800 magnet level. Looking at options, we’re in negative gamma territory, which means “chasing the price.” Price moves become more enhanced, so if the market goes down, we will see sharper downward moves or vice versa.

Source: Traderade.com

Next week will bring us the proper start to earnings season and the CPI numbers. The CPI numbers will be key because we all know that the Fed’s focus has turned towards inflation now. However, one number doesn’t make a trend but could certainly move markets for the day. We doubt the Fed will cut rates this month even if we get a softer CPI number, given the strong labor numbers that we got.

Commodities

Source: Koyfin

We’re seeing some action in commodities over the past week. With a colder winter, NatGas and to some extent oil prices have been going up. The return of inflation also means we’re likely to see focus on commodities. It’s worth keeping an eye on these numbers.

Gold prices are also starting to head higher again, and my bet is that this boils down to the uncertainty in the markets.

Macro - Yields at 5% could be a reality

It would seem that “good news is bad news” once again. Two news items that really rocked the boat this week were the jobs report and the consumer sentiment reading, both released on Friday. Earlier in the week, we did start to see some pressure because of a higher JOLTS number, signifying a tighter labor market. But the Non-farm Payroll additions on Friday were far above the 157k consensus estimate coming in at 256k and higher than the revised 212k number from the previous month.

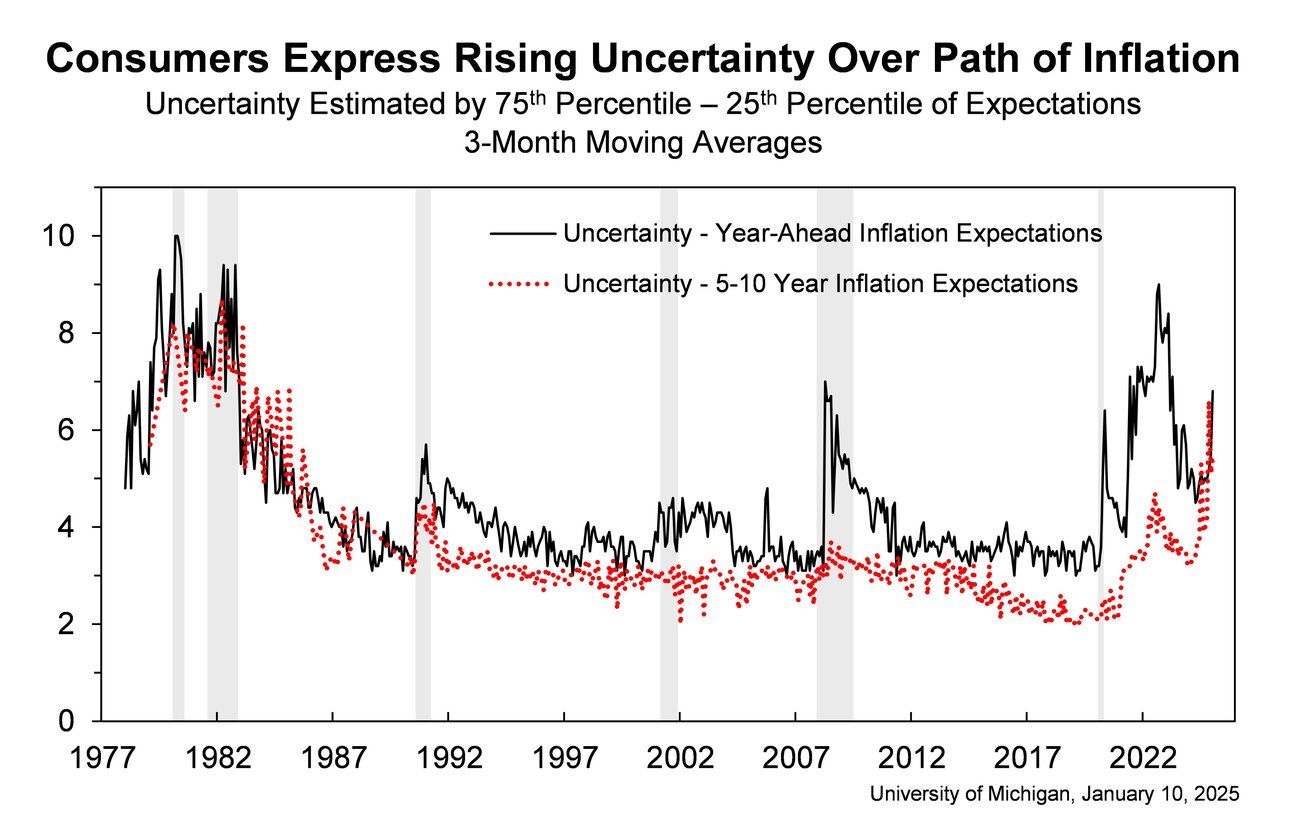

As for the Michigan Consumer Sentiment data, we got a spike in inflation expectations. When I talked about the bond market fearing inflation earlier in the week, I was hit with a few comments saying, inflation expectations still remain well anchored. It would seem that’s not entirely the case anymore, and there is concern surrounding not just one-year ahead inflation, but long run inflation as well.

“Year-ahead inflation expectations soared from 2.8% last month to 3.3% this month. The current reading is the highest since May 2024 and is above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations rose from 3.0% last month to 3.3% this month. This is only the third time in the last four years that long-run expectations have exhibited such a large one-month change. “

Bond yields during the last Trump presidency were at much lower levels and there was room to the upside. At present, we’re seeing some difficult conditions because we were already at much higher levels and now we have:

uncertainty surrounding the fiscal agenda and how the deficit will be managed

upside surprises in macro data leading to higher inflation expectations leading to lower Fed cut expectations.

tax cuts could lead to further Treasury issuances

a large amount of short-dated treasury bills are coming up for renewal (over $9 trillion)

the last 10Y auction wasn’t great which tells us that people are still not rushing to buy longer-dated treasuries even at this level (lower demand = lower prices = higher yields)

Bond buyers are demanding more premium for taking on these risks.

The result is pressure on stocks.

We’ve always maintained that when the 10Y yield goes above 4.5%, we’re likely to see pressure on the market as a whole, not just yield-sensitive and unprofitable companies.

US 10Y Treasury Yield - Monthly Chart

With that, we think that yields could run to 5% and there is room for further pressure. But, we also think that this pressure could be curbed temporarily by upcoming events:

President Trump’s Inauguration - This won’t be a magic bullet but, I think with where yields have reached, we’re likely to see some of the markets concerns assuaged during the inauguration. Let’s not forget, Trump has always been a businessman.

Earnings Season - We talk a little more about this in the next section but the bottom line is that while expectations have been tempered somewhat, we’re still likely to see some of the larger companies deliver a solid set of earnings. The outlook is what we will be focusing on.

In the long run though, even the Fed is warning us of higher rates. If the new administration’s policies continue to move towards trade wars, tariffs, lower immigration, and lower taxes, we could be in for a rough ride.

Earnings - A Bumpy Season Ahead

US earnings season starts in full flow next week. This is the earnings for Q4, 2024 and the forecasted EPS growth is 11.9% for the S&P 500. This is down from a forecast of 14.5% in September, according to FactSet. So while expectations continue to remain relatively high, they have been tempered somewhat. Valuations continue to remain rich overall, and with the Fed slowing down on rate cuts we’re likely to see a slowdown in terms of multiple expansion.

At the outset of this earnings season we have multiple factors to consider, and this could lead to a rather bumpy earnings season. We still expect relatively solid earnings from the large caps. While the reported numbers will be what they will be, the earnings calls could lead to volatile price action as we start to hear about how companies are getting ready for the policy impacts of the new administration.

We will be on the lookout for discussions surrounding:

Slower Fed rate cuts and A stronger US Dollar (60% of the S&P 500 derives income from overseas)

The impact of Tariffs, possible Exemptions, and whether Reshoring can offset some of that

The fear of higher wages because of lower immigration, and a tighter labor market

Finally, whether tax cuts will offset higher prices and higher rates

All of these comments are sure to impact price action, even if results come in fairly decent for companies. The focus will be on the outlook even more than in previous earnings seasons.

Closing Thoughts - Can the Fed cut in 2025?

The Fed went too far cutting 100bps in a matter of 4 months. Their whole basis for the cuts was the weak labor market. At the time, we were surprised because we were not seeing the kind of weakness that the Fed was talking about. Nevertheless, I chalked it up to them having more data and over a hundred economists on the payroll.

Fast forward, four months and most people agree that the Fed went overboard with the rate cuts. Now, there are people questioning whether the Fed can cut at all in 2025, give what the data is telling us. We’re always at extremes with projections!!

I think the Fed will still cut rates and, I stick with my projection of 2 cuts, with a possible 3rd by the end of the year, if inflation does re-accelerate substantially. Having said that, most of the meetings this year will be nail-biters and every macro data linked to inflation will be in focus.

Have a safe trading week out there!

Sincerely yours,

Ayesha Tariq, CFA

There’s always a story behind the numbers.

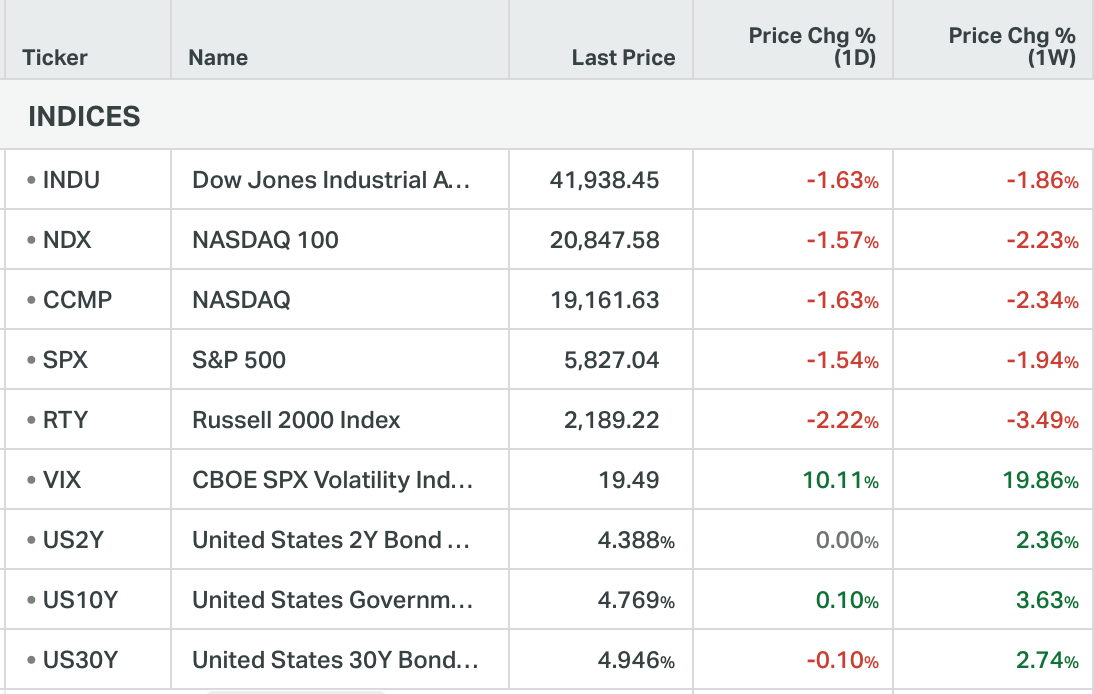

Calendars

US Earnings Calendar

US Economic Calendar in Eastern Time (Source: Trading Economics)