Welcome to another issue of the Weekend Edition.

Thank you to all who’ve read and welcome to all the new subscribers this week!

Here’s what we cover:

Market Recap - Nasdaq goes red!

Macro - Retail Sales and Industrial Production

Earnings Recap - JNJ, Intuitive Surgical, FCX, Alcoa, Amex, CSX

The Week Ahead - Economic & Earnings Calendar

Closing Thoughts - We’re on a roll!

Let’s dive in ⬇️

Market Recap - 17 Jul - 21 Jul, 2023 📉📈

Following a massive week of central bank and earnings headlines, the week of 28-Jul looks just as busy from both a macro and micro perspective. On the macro front, the focus will be on employment, with JOLTS job openings for June and ADP private payrolls and the official employment report for July. Wages likely to get even more attention with Powell's recent comments about the outsized importance of inflation on the Fed's policy calculus. Both the July ISM manufacturing and services surveys are out next week as well with the latter likely to attract more scrutiny following the softer-than-expected flash services PMI and some earnings season hints that the normalization tailwind may be slowing a bit. Over 160 S&P 500 companies representing nearly 30% of the index's market cap are scheduled to report, including Apple and Amazon on Thursday. AMD, Qualcomm, Pfizer and Merck some of the other notable reporters.

Commodities

Prices in the agriculture complex are starting to increase again with the Russia-Ukraine grain deal being called in question.

The charts in the recap section have been sponsored by Koyfin. We have a special discount of 15% for MacroVisor readers for any new sign-ups to Koyfin. To take advantage of this promo please sign up here - Koyfin MacroVisor Discount

Macro Roundup - Retail Sales and Industrial Production

Retail Sales

Retail Sales, while in decline, is still holding up. We saw a positive number come in both Month on Month and Year on Year.

Industrial Production

In contrast to Retail Sales, Industrial Production fell for a second month in a row coming in at -0.5% MoM. Last month’s number was revised downwards from -0.2% to -0.5%.

Bottom line: Manufacturing continues to slow and create a drag for the economy. This is something to be mindful of when looking at the Industrials Sector.

Earnings Season - Mixed Results

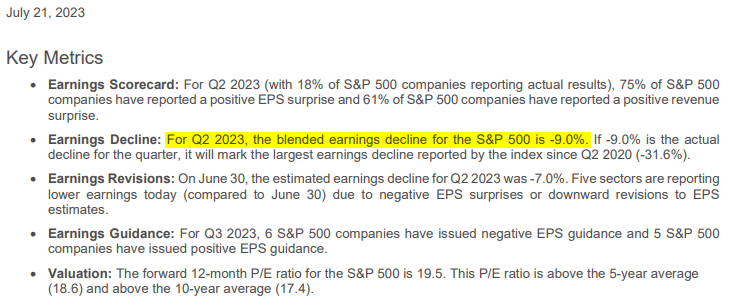

FactSet Summary

Healthcare was the top performer last week with both JNJ and Abbott delivering earnings beats. J&J saw outperformance in their MedTech which grew 12.9% YoY. Intuitive Surgical also increased its FY23 procedure growth guidance to +20-22% YoY, a nice bump from +18-21%, which was already a considerable jump from the company's initial +12-16% forecast. Medtech is getting a nice boost!

The Week Ahead 📅

US Earnings Calendar

US Economic Calendar in Eastern Time

Closing Thoughts - Brace yourself

Here’s wishing you safe investing.

Sincerely yours,

Ayesha Tariq, CFA

There’s always a story behind the numbers.